4G and 5G private networks are at an inflection point. A burst of open software network vendors and some significant deployments has opened the debate about the high costs of traditional 5G networks against the risk of integrating best-of-breed open software, albeit with the prospect of much lower capital and operating costs—and faster INNOVATION.

Private networks and the allure of ORAN

Proprietary RAN solutions account for 60 percent of network costs. Open networks reduce costs by using commodity hardware and will increase competition with lower barriers to entry. Private networks typically cater to use cases unique to an entity or a local region and cannot financially justify the high costs of proprietary RAN. However, the touchstone of success in Open RAN is skillful system integration which is risky because a network integrates multiple sub-systems.

Many fear that the cost of integration eventually offsets the initial benefits of lower hardware costs. While the financial case for ORAN in rural areas is compelling, some have raised concerns about radio interference and other spectral efficiency issues, in urban areas, with their dense deployments.

Interest in Open RAN has surged among private network providers. The establishment of the Telecom Infrastructure Project (TIP), the leading industry sponsor of ORAN, is committed to “a new approach to manage and operate 5G private networks, based on a cloud-native architecture, and making use of a new class of software management tools.” System integration technologies are a concern, as suggested by Caroline Chan, a TIP board director, who said, “through the recently launched solution groups, TIP is expanding its scope to include the validation of interoperability between different elements across the whole network, and insights and recommendations about how to operate them.”

In its efforts to expand access to the Internet in underserved areas, Facebook Connectivity has sponsored TIP. It is financing network software development, in partnership with Marvell, to expand the usage of ORAN through the Evenstar program within TIP. Inland Cellular achieved early success in remote regions of Idaho, where ORAN adoption has accelerated the growth of the network with a 40 percent reduction in network costs.

Uses of ORAN Private Networks

The appetite for ORAN private networks is growing in the enterprise as it uses it in innovative ways to gain efficiencies in operations. Inventec, a Taiwanese hardware manufacturer, opted for a virtualized private network with core network software from Affirmed, a Microsoft company. A key advantage of Affirmed is the ability to deploy the core at the edge or on-premises. It is now possible to move larger volumes of inspection image data to a server for analysis with AI. Inventec has reduced its re-inspection labor force by 50 percent after installing the 5G ORAN network and changing factory lines faster. Wave-in, the VAR for the project, did the system integration.

Nokia is scaling a similar strategy for bringing the core, for open private networks, to the edge in collaboration with multiple cloud companies starting with Google. Its partnership with Amazon AWS Outposts will involve extending the ORAN mobile network infrastructure to any premise, co-location space, and datacenter. Microsoft Azure will help build a 4G/5G private network wireless solutions for the enterprise involving use cases such as robotics and mixed reality.

Dish Network, which will have a greenfield deployment in the USA, starting with the launch in the third quarter of 2021 in Las Vegas, takes a similar approach with Amazon AWS Outposts. The partnership with Amazon is in anticipation of the deployment of massive MIMO Open RAN.

IBM is collaborating with Samsung to deliver Industry 4.0 solutions over private networks in Singapore. Samsung’s hardware will work with Red Hat’s OpenShift containerization software and IBM’s AI solutions for use cases such as IoT-based object identification, instructions for manual processes conveyed with augmented reality, and robotics.

German federal network agency Bundesnetzagentur has awarded 123 spectrum licenses for private 5G campus networks. The earliest testbed deployments were at Fraunhofer IIS for Industry 4.0 and logistics.

System integration will clinch the deal

Rakuten Mobile, a leader in the OPEN RAN space, brought a communication platform space to simplify system integration. It also demonstrated the viability of integration by interlinking ten vendors. One of its fifteen clients, Etisalat, attributed the successful deployment of its ORAN solution to Rakuten’s communication platform and has entered into a long-term agreement to build future mobile networks based on the communications platform. The focus of the communication platform is a private and on-premises solution for both digital services and operations.

Service providers also do not see the integration challenges as deal-breakers. They are willing to embrace Open RAN if it provides them with 80 percent of networked systems’ performance capabilities, especially in underserved areas.

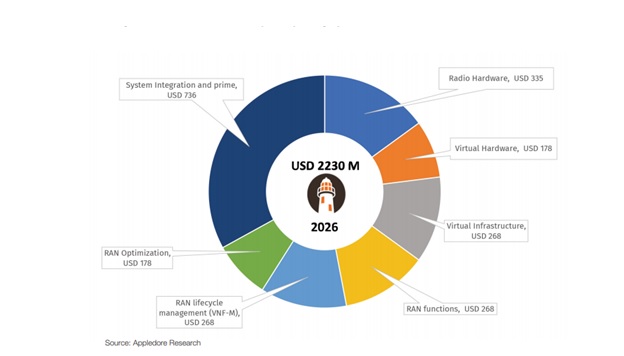

System integration is emerging as the most significant component of the multi-vendor ORAN, and is expected to account for 33% of the total multi-vendor ORAN market spending by 2026 as per Appledore Research..

Conclusion

Private networks will dominate the market for commercializing use cases at the edge. Most of such use cases need the flexibility to design solutions for clients’ specific circumstances with parameters predetermined by them. Such solutions need to lower costs as they cannot defray capital costs to many customers. Open RAN is the way to go to lower costs. So much, however, hinges on system integration.