The US is one of the top markets for private LTE and 5G wireless networks globally, with North America having a 31% global market share. The top verticals using private networks in the country include manufacturing/factories, energy/utilities, transportation/logistics, and the Department of Defense. Revenues for Private LTE in the US are expected to grow from roughly $1B in 2021 to $2B in 2028 (a CAGR of 10.7%), while the burgeoning Private 5G market is expected to skyrocket from $430M in 2021 to $4.3B in 2028 (a CAGR over 40%).

US enterprises typically have three types of spectrums available for private cellular networks: licensed, unlicensed, and shared.

- Licensed: Typically assigned from a Mobile Network Operator (MNO), which owns the rights to that band allocated by the FCC.

- Unlicensed: Freely available; anyone is allowed to use it. Examples are the 2.4 and 5.0 GHz bands for Wi-Fi (and the recently opened 6 GHz)

- Shared: In the US, shared spectrum refers to the 150 MHz swath in the 3.5 GHz Citizens Broadband Radio Service (CBRS – unique to the US), typically running LTE but with 5G on the near horizon.

Most companies in the US use one of the above methods for private networks, with various factors taken into consideration for each instance. A primary factor for K-12 education is often coverage, with the intent to provide broadband access to students’ homes, factories with high-speed automation needing low latency, and healthcare requiring high throughput. Regardless, the adoption of private cellular networks is rising across all verticals.

Healthcare

The data generated in the healthcare industry is projected to grow faster than any other industry between now and 2025, with large imaging files the primary culprit. These files need to be moved around hospitals, often quickly (e.g., from the MRI room to the emergency room), and the facility’s wireless networks will need to have the capacity to handle these data transfers. Other intensive data uses include the growing business of telehealth visits, augmented reality (AR) uses in the operating room and training facilities, monitoring of patients with wearables or Fitbit-like devices, and outdoor coverage for emergencies, where triage stations are set up. Benefits for private cellular networks in healthcare facilities involve tracking equipment, data security – where HIPAA (government medical data requirements) is of significant importance, and freeing Wi-Fi spectrum for patients and visitors.

Memorial Health Center in Springfield, Illinois, set up outdoor triage tents to handle the influx of patients from COVID-19. Memorial worked in conjunction with CommScope, RF Connect, and Druid Software to run LTE on CBRS with a MiFi (mobile Wi-Fi router) to cover the outdoor tented area. A significant benefit of using CBRS was the speed in which coverage was provided – one day, without the need to have Ethernet cables placed. The hospital’s Wi-Fi network didn’t reach the outdoor site, and HIPAA made “them hesitant to put that data on a public cellular network.”

In Chicago, the Rush University Medical Center also installed a CBRS 3.5 GHz band network for outdoor triage tents to handle COVID-19 patients.

A private 5G network running in the mmWave (millimeter wave) band, which operates at 28 GHz and above, is being installed by AT&T at the Ellison Institute for Transformative Medicine in Los Angeles. The high data transfer rates possible at that bandwidth appeal to the Institute, which carries out cancer research, and generates enormous files with, for example, 3D tumor imaging. The private network allows for faster analyses. The goal is to “collect and keep data within their labs without having to send it to the cloud to be analyzed.”

(For further information, read Private Networks Are the Right Medicine)

Municipalities

Cities and counties are rolling out LTE and 5G private networks across the country, with standard use cases being coverage for education, traffic management, smart parking, and monitoring of water and lights. The eventual goals will be to create a smart city, a government that “uses information and communication technology (ICT) to improve operational efficiency, share information with the public and provide a better quality of government service and citizen welfare.”

Harris Country, Texas, the site of the country’s 4th largest city, Houston, has deployed a private LTE network supporting 1,000 houses on CBRS. Free CBRS modems are provided to those in covered areas who can use personal Wi-Fi in their homes and CBRS for backhaul. The network runs under General Authorized Access, meaning there are no usage fees. Motorola is providing the hardware. Support for 6,000 homes is expected to be in place by the end of 2021.

Las Vegas, Nevada, has installed what private network provider Terranet Communications claims is the “largest private, municipal LTE/5G network” in the country. Terranet brought Open RAN provider Baicells to help with the CBRS network. The network connects “students and educational institutions in the city but will also be used for other “community assets” and could stretch into neighboring areas.” The LTE network is described as “5G-ready.”

Las Vegas is also creating “Industry Zones,” with the help of Vapor IO, who are working with Terranet to expand the existing network, along with Amazon Web Services and VMWare. The first “InZone,” which encompasses the Vegas Strip and nearby areas, will initially serve local schools but “potentially serve local government, manufacturers, retailers, hospitals, hotels, convention centers, and casinos.”

Tucson, Arizona, has deployed an LTE CBRS network with the help of JMA Wireless and Geoverse, a private network operator. Initially, the network will “support remote learning and multiple smart city applications.”

Military

The US Department of Defense (DoD) is an eager participant in the rush to build private 5G networks, as the “US military has emerged as the largest current buyer of hardware, software, and services related to private 5G wireless networks,” according to a panel at Connect(X) in October 2021. The DoD in 2020 announced $600 million for 5G experiments around the country, “representing the largest full-scale 5G tests for dual-use applications in the world.” Use cases will include “piloting 5G-enabled augmented/virtual reality for mission planning and training, testing 5G-enabled Smart Warehouses, and evaluating 5G technologies to enhance distributed command and control.” The Joint Base Lewis-McChord facility in Washingon will use 5G equipment from Samsung in the mid-band spectrum, in conjunction with AT&T, Oceus Networks, and Booz-Allen Hamilton.

One private 5G network is being built at the Marine Corps Logistics Base in Albany, Georgia, with equipment from many companies, including JMA Wireless, Perspecta Labs, GE Research, and KPMG. The smart warehouse prototype will run on mid-band and mmWave bands and support download speeds to 1.5 Gbps and latencies of 15 milliseconds.

The DoD is also installing private 5G networks at Hill Air Force Base in Utah and three other sites. Focus areas will include “integrating augmented and virtual reality into mission planning and training and leveraging 5G’s ability to enhance logistics operations and maximize throughput.”

Other US-based companies will be involved in the work at the five bases, including AT&T, Oceus Networks, Booz-Allen Hamilton, Vectrus Mission Solutions, Deloitte Consulting, and Scientific Research Corporation.

Automotive

Automobile factories, with their large number of workers, the constant influx of new parts and exit of finished cars and trucks, and precision work needed, are prime sites for the advantages seen in 5G: low-latency, high throughput, and connection capability for millions of non-computing devices (Internet of Things (IoT)).

Ford Motor Company announced in October 2021 that they are going to build a private 5G network at a factory where they will produce an electric version of the top-selling F-150 truck. AT&T will deploy the network to improve their manufacturing technologies, “communicate information and images,” and improve safety by “helping automated robotics and machinery make better decisions and react faster.”

General Motors installed a private 5G network at an all-electric vehicle assembly plant in Detroit with the help of Verizon, with a critical goal to manage “thousands of devices across Factory ZERO’s more than 4 million square feet of space.”

Education

The use of private networks in education has continued to grow significantly since the beginning of the COVID-19 pandemic. Like many in the world, students in the US were suddenly forced to attend classes virtually and do homework online. Many students live in houses or neighborhoods with poor if any coverage, and school districts scrambled to provide sufficient coverage and capacity for their schoolchildren. Networks can also create ‘smart’ classrooms, improve campus transportation, and keep track of school resources.

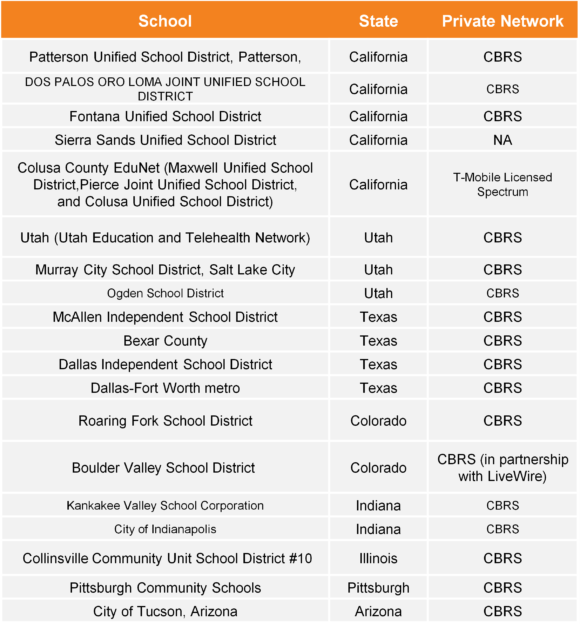

CBRS is the most common band chosen for K-12 private networks in the US.

In Utah, the Murray City School District built its own CBRS network with help from Telehealth Network, Ruckus Networks, and Cradlepoint. Now, “students can connect their district-issued Chromebooks to for free, high-performance Internet access.” “Tablets like Apple’s iPad and iPad Pro support CBRS natively and give students immediate access to the network.”

In California’s Dos Palos Oro Loma school district, Nokia and AggreGateway are teaming to provide 4G Fixed Wireless Access (FWA) using GAA CBRS to 2,400 students on five campuses and their homes. Coverage will allow this rural area to bridge the ‘homework divide,’ the inability of students to do classwork and homework from their homes due to lack of broadband access.

In Illinois, the Collinsville Community Unit School District #10 deployed a private LTE CBRS network with the help of Nokia, Cambium Networks, and IT solutions provider STEPcg, to bring connectivity to roughly 500 students. “Internet connectivity ensures all students are able to complete assignments, conduct research, interact with classmates and teachers, apply for scholarships, seek employment, and participate in everyday occurrences as simple as seeking the answer to a random question.”

It’s not only the K-12 schools embracing private networks; college campuses are also. At California State University in Stanislaus, private networking company Celona deployed an LTE CBRS network designed to create “dynamic and collaborative outdoor learning centers” for its 10,000 students and staff. The network will backhaul Wi-Fi traffic, saving the university money as it doesn’t need to lay more fiber for the task. Carnegie Mellon University in Pittsburgh, Pennsylvania, worked with JMA Wireless and AWS to deploy an LTE CBRS network. The purpose of the network is to provide aid to the Living Edge Lab, an edge computer research lab. AT&T is installing a private 5G network at the Stamford campus of the University of Connecticut, with plans to open this summer. It will run in the so-called “millimeter wave (mmWave)” band, which operates at 28 GHz and above in the “high-band” wireless arena. The goal is to “advance academic programs that will explore new use cases and expand entrepreneurial activity.”

(For further information, read Education Goes Private (But Not In The Way You Think))

Other industries

Other industries in the US are also considering or taking advantage of the benefits provided by private networks.

- The 7 Cedars casino in Washington state is remotely located, and operators have been reluctant to install sufficient network access and capacity for the casino and their guests. 7 Cedars is teaming up with licensed mobile network operator (MNO) Geoverse to build an extensive private LTE network in the CBRS 3.5 GHz band. It will cover the casino, three restaurants, and a new hotel. “The network will provide up to 5-bars of connectivity and support a wide range of new applications and Internet of Things (IoT) devices.”

- Boingo, a DigitalBridge company, installed a private LTE network on the unlicensed part of the CBRS 3.5 GHz band for the San Diego Padres in late 2021. The network was deployed with Federated Wireless, Cisco, and CommScope. It will be used to “handle cash-free payments, contactless concessions and mobile ticketing in its stadium” and accessed via Apple iPads by the 1,000 staffers at Petco Park. Padres CEO Erik Greupner says it may be used for sports gambling in the future.

- The Caribe Royale Resort in Orland, Florida, a large hotel and convention center, is working with Geoverse to deploy a CBRS-based neutral host network. Initial applications include indoor coverage in the convention center with subsequent iterations to handle the significant traffic expected from 1,300 suites and 220,000 square feet.

- The Utility Broadband Alliance announced in 2021 that it is officially a not-for-profit organization whose goal is “dedicated to advancing and developing private LTE broadband.” They are “a collaboration of utilities and ecosystem partners dedicated to championing the advancement and development of private broadband networks for America’s critical infrastructure industries.”

- John Deere, a company best known for its’ agricultural machinery, purchased five CBRS licenses at the 2020 FCC CBRS auction. They plan to install private 5G networks at two Illinois factories and work without connecting to a public network. The networks will be used to “connect machine centers and even hand tools” and improve the operation of their connected robots and autonomous guided vehicles.

Conclusion

The US market for private networks will continue to blossom, with 5G slowly overtaking LTE, thanks to its speed, latencies, and IoT capabilities. The data capabilities open the door for UHD video, allowing remote inspection of dangerous travel areas (e.g., mining) and remote quality inspections, cutting travel costs. Low latencies allow improved robotics and autonomous vehicles. The IoT allows for logistics tracking on an immense scale. LTE will continue to proliferate, propelled by the CBRS band and its’ sharing of spectrum, with many using it without access fees (GAA).

Learn more about Private LTE Network