High-speed broadband internet access is transforming from a luxury to an essential utility for households and businesses alike. Historically, wired connectivity technologies like cable, DSL, and fiber have dominated yet faced challenges reaching some rural or low-density areas. Now, innovative wireless options are stepping in to fill coverage gaps with faster speeds, greater affordability, and competitive choice.

The emergent fixed wireless access (FWA) platform leads this new wave. By leveraging cellular advancements in 4G and 5G combined with targeted network equipment, FWA delivers high-capacity wireless signals the “last mile” to fixed location receivers. Buildout costs are far lower than trenching fiber, enabling rapid deployment by wireless ISPs (WISPs), rural co-ops, carriers, and more. With transmitted speeds exceeding 100 Mbps and competitive pricing, FWA is a game-changer for broadband delivery.

What are the Key Drivers?

There are several reasons for the emergence of Fixed Wireless Access (FWA) as a practical alternative to wired and other wireless solutions.

Increasing demand for high-speed broadband internet – As more activities move online, from video streaming to smart home devices, there is growing consumer demand for fast, reliable broadband connections. FWA can provide broadband speeds comparable to fiber or cable to homes not reached by those wired networks. As well, the growth of mobile businesses, such as food trucks and pop-up shops, has introduced a new mobile broadband market.

Lower deployment costs – Building out fiber or cable networks requires significant infrastructure costs to lay wires. FWA leverages existing cellular towers and wireless transmission, reducing costs to provide broadband, especially in rural or remote areas. It’s a more economical way to expand internet access.

Robust security – Fixed wireless access builds upon the same 4G and 5G cellular standards used for mobile connectivity. This foundation allows FWA providers to leverage the sophisticated security frameworks already proven across public wireless networks. Specifically, FWA inherits the 3GPP security protocols deeply integrated into all licensed cellular networks.

Adaptability and Expandability – FWA networks can effortlessly adapt to evolving business requirements, allowing seamless scalability. Whether expanding operations or responding to variable demand, FWA offers essential flexibility.

Technological improvements – There have been advancements in wireless technologies such as 4G and 5G networks, Wi-Fi, MIMO antennas, beamforming, carrier aggregation, and modulation techniques that allow for faster speeds and greater capacity from wireless broadband. The proliferation of mid-band and millimeter wave (mmWave) frequencies provides the bandwidth necessary for the needed throughput.

Government subsidies and policy – Governments are offering grants and subsidies to encourage internet service providers to provide affordable wireless broadband in underserved communities through fixed wireless towers and antennas. U.S. federal agencies consider FWA a viable broadband technology, rendering it eligible for inclusion in federal funding programs like Broadband Equity, Access, and Deployment (BEAD) and the Rural Digital Opportunity Fund (RDOF).

Rising competition – The entry barriers are lower for fixed wireless than fixed wireline, allowing more WISPs and competitive carriers to deploy broadband access via FWA. This expands consumer options and drives faster adoption of the latest technical standards.

Comparison to Other Connectivity Technologies

How does FWA compare to other technologies?

- Cable and DSL require wired infrastructure all the way to homes and businesses and, in practice, are roughly limited to 25-300 Mbps and 0.5-75 Mbps, respectively. One major MNO claims its mid-band FWA customers get 300 Mbps while mmWave spectrum users can get up to one Gbps.

- Fiber offers the fastest speeds but has very high deployment costs. However, fiber is often the perfect backhaul solution for both mobile and fixed deployments.

- Satellite service has higher latency times and costlier monthly bills for subscribers than FWA.

The Numbers Look Promising for FWA

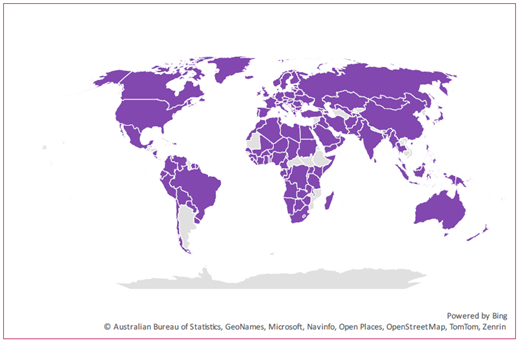

Although FWA is not a recent technology and can function with either LTE or 5G, the new technologies and widespread adoption of 5G have significantly increased the number of FWA deployments. The GSA’s Fixed Wireless Access (11/23) report states that 554 operators in 187 countries and territories offer LTE or 5G service.

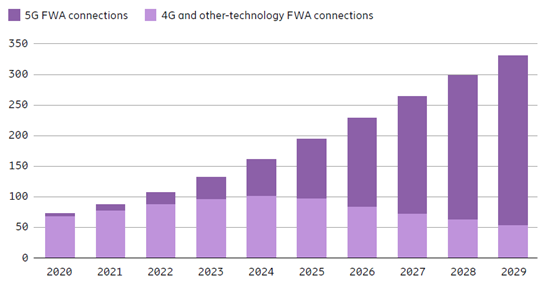

Globally, the number of FWA connections is expected to grow to 330 million by the end of the decade, per the Ericsson Mobility Report (11/23), with 5G soon becoming the majority of connections.

Regionally, Ericsson reports that over 80% of mobile operators offer FWA in North America, Western Europe, Central and Eastern Europe, the Middle East, and Africa.

FWA is not Just For Rural Communities

Although FWA is primarily thought of as a means of delivering broadband services to rural and underserved areas, basic services are not the only use for it.

“…fixed wireless deployed on top of mobile networks continues to be a big success for T-Mobile and Verizon…” Top Broadband Developments of 2023 – Telecompetitor

FWA presents a cost-effective deployment option for Mobile Network Operators (MNOs). Leveraging the same cell towers and base stations as traditional mobile connectivity, MNOs can utilize their existing 5G infrastructure for FWA implementation. For instance, if an MNO possesses surplus 5G capacity in a particular cell tower, it can offer this connectivity to nearby customers.

MNOs can capitalize on their pre-existing infrastructure and equipment by selling this excess capacity at competitive prices. Furthermore, the reusability of 5G infrastructure for FWA, coupled with the absence of physical cables required for FWA, streamlines the deployment process. Using existing equipment not only results in significant time savings but also reduces costs for MNOs.

Conclusion

Fixed wireless access has emerged as a transformative broadband platform uniquely positioned to meet the connectivity demands of the 2020s and beyond. FWA brings a compelling mix of attributes – from rapid rollout to competitive speeds to robust wireless security. For rural regions lacking wired infrastructure, it enables modern broadband access at reasonable economics. For urban centers filled with frustrated cable subscribers, it injects welcome competition and choice. And for mobile operators, it unlocks value from existing cellular infrastructure.

Key drivers behind FWA adoption show no signs of slowing down. Ongoing technology improvements will further close any remaining performance gaps with fiber. Government funding and policies will continue to promote further deployment and accessibility. Market competition is heating up as traditional MNOs, MSOs, and WISPs all vie for a piece of the widening FWA opportunity.

By inheriting the mature security foundations of cellular networks and leveraging cloud-based intelligence at the edge, FWA platforms continue to navigate an increasingly wireless future smartly. Far from a niche solution, fixed wireless access brings the exciting promise of connections unfettered by wires, unwavering reliability, and uncompromised value. For vast underserved and unsatisfied markets alike, the time for fixed wireless is finally here.