Fixed Wireless Access (FWA) is a fast-growing and affordable means of providing and supplementing broadband access to businesses and consumers without the need for operators to have a physical connection to each recipient – the ‘last mile’ is wireless. FWA has been around for years, but the advent of 5G, with its higher capacities and better reliability than LTE, has made FWA an attractive new revenue stream for service providers. With 5G, FWA can provide customers with a broadband experience rivaling FTTH, xDSL, and cable, but without the need to dig trenches to each home and business. In the US, operators can expect to deliver the FCC’s 25/3 Mbps speeds currently required and the 100/20 Mbps speeds presently discussed by the government as the next-level requirements.

What Frequencies are Used for FWA?

FWA is provided primarily over mid-band frequencies and mmWave bands. In the mid-band range, both C-band and CBRS (in the US) are used, with the 3.5 GHz CBRS popular due to its shared spectrum status, making it free to use in many areas. Wireless Internet Service Providers (WISPs) have found LTE-based FWA an option using CBRS.

The mmWave bands, roughly 24-40 GHz, are used due to their wide channel size and lower latency. US Cellular has performed tests reaching multi-gigabit speeds over seven kilometers using mmWave. Other operators are using the 60 GHz band. “It’s every bit as fast as fiber. With 60 GHz cnWave, we can now offer Gigabit download and 100 Mbps uplink, or greater,” said Jeff Hardesty, Vice President and co-founder, Desert iNET. The challenge with mmWave is that the signal doesn’t travel far and often has trouble penetrating windows or buildings.

Why is FWA Important?

FWA is important to providers for two reasons: one, it provides them a new market either in the form of communities lacking broadband or in areas with limited sources for access; and two, it offers them the ability to increase their throughput in areas they already serve. When using existing infrastructure such as poles and backhaul, the cost to provide additional capacity is minimal.

For consumers, whether residential or business, the rise of FWA is expected to lower broadband prices in the communities they serve. Competition will encourage innovation as well as disrupt existing pricing models.

The Big 3 US Operators (i.e., T-Mobile, AT&T, Verizon) are all investing in FWA technologies. While there are roughly seven million FWA users in the country today, T-Mobile expects to add 7-8 million FWA customers in the next five years, and Verizon’s expected FWA revenues correspond to 1.5 million subscribers by 2023.

Where is FWA Being Deployed?

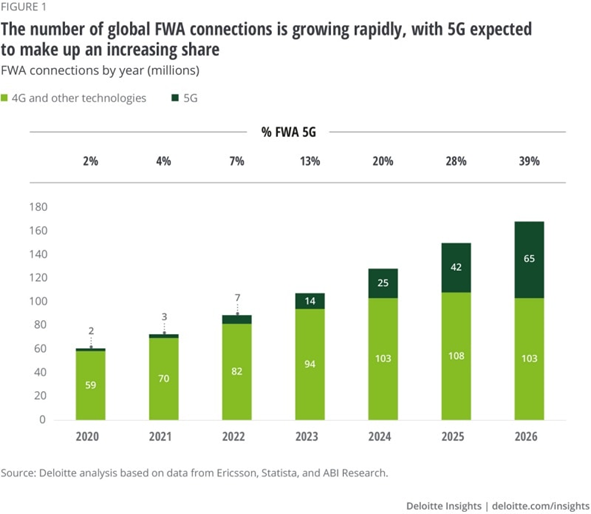

The global market size for FWA continues to grow significantly. Deloitte estimates a 19% CAGR in the number of connections from 2020 to 2026 but an 88% CAGR in the number of 5G FWA connections.

The global 5G FWA market is forecast to grow from 2019 to 2026 at a CAGR of 135%, reaching $86.5 billion.

Per Ericsson’s mobility report, roughly 77% (239 of 312) of global service providers had an FWA offering, with more than 50% of the operators in each region offering FWA. In a June 2021 report, the GSA reported 436 FWA networks in 171 countries. Forbes writes that there are roughly 2,800 FWA providers in the US today, covering MNOs, WISPs, regional operators, and others.

Global Deployments

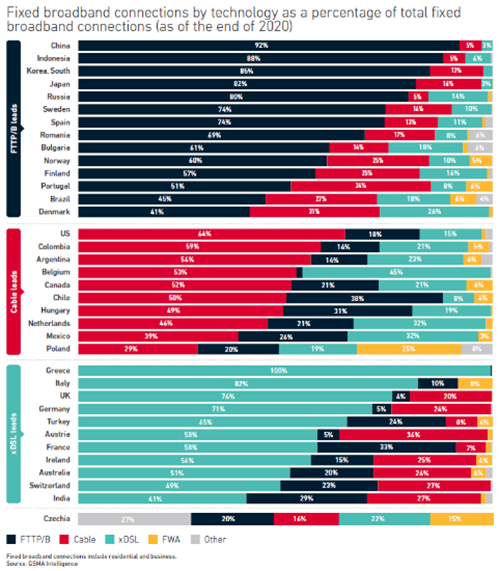

GSMA Intelligence shows the percentage of users in specific countries who use fiber, cable, xDSL, and FWA. Poland, with 25%, and Czechia, with 15%, are the only countries where more than 10% of broadband customers are using FWA.

Regional Uses

FWA is often used in unserved and underserved areas to provide high-speed internet access and in urban and suburban areas to increase capacity.

The Technologies that Make FWA Work

In addition to the network improvements possible when moving from LTE to 5G, several other technologies are integral to FWA, such as massive MIMO, beamforming, and devices for the home/office.

Massive MIMO antennas and radios have hundreds or thousands of elements that are each ‘tuneable.’ Each element increases transmission gain and spectral efficiency. A 2T2R antenna roughly doubles the amount of data going through it, and 4T4R antennas quadruple it. mMIMO antennas in the field today are as big as 32T32R and 64T64R.

Beamforming allows multiple antenna elements to send the same signal to one receiver. Consequently, the connection is faster and more reliable.

Customer Premises Equipment (CPE) are the devices the consumer uses to access the FWA network. CPEs can be positioned either outdoor or indoors. Outdoor models are usually professionally installed, higher-powered, and well-suited to high-frequency bands. Indoor models only need to be plugged in, saving truck rolls, but don’t work as well with mmWave signals, which often have trouble penetrating windows or walls. There are now more than 130 CPE devices available from over 50 vendors.

When is FWA the Right Play?

Operators consider many factors when deciding whether to offer service in a given area and what kind of delivery mechanism, such as FWA or Fiber to the Home/Premises. Factors include:

- Population density – are there enough people and businesses to support a strong business plan?

- Type and cost of spectrum available – does the operator own spectrum, or is there shared spectrum with a free option, such as CBRS in the US?

- Terrain – does the geography block wireless signals, or are there waterways or other obstacles over which it would be challenging to lay fiber?

- Capacity – will there be sufficient throughput to meet government requirements and customer needs?

- Existing infrastructure – are there existing poles and ducts for fiber? Is there existing wireless equipment in place for transmission and backhaul?

- Market share – what percentage of the covered area will be customers?

- Government assistance – are there programs to help cover the cost of building and maintaining the FWA network? Examples include the Rural Development Opportunity Fund (RDOF) in the US and Project Gigabit in the UK.

When comparing FWA and FTTH deployments, one factor in the former’s favor is the increased speed at which an FWA network can be deployed and begin operating. Removing the need to lay fiber to each home and business saves time and money.

FWA Success Stories

FWA deployments are happening around the world.

- In the US, Samsung and t3 Broadband are providing Mercury Broadband with 64T64R Massive MIMO equipment to supply the rural mid-west with 500 cell sites for their FWA network.

- In the Middle East and North Africa, Nokia and Ooredoo use FWA and Wi-Fi to deliver smart home services and high-speed services such as gaming.

- In Australia, NBN uses government funds to complement its investment, bringing 5G and faster speeds to semi-rural and remote areas of the country.

- In Canada, Telus brings speeds up to 100 Mbps via FWA to rural areas in British Columbia and Alberta.

FWA Challenges

FWA does have some challenges associated with it. The primary one is that operators can’t have too many users in a single sector, or the network becomes congested. T-Mobile has “…explained that in areas where it offers FWA, it places a cap on the number of FWA customers it will accommodate. Once it’s sold FWA to the prescribed number of customers in a given area, that sector will then be closed to new customers until someone churns off.”

Conclusion

The implementation of FWA in the market will continue to grow, helped mainly by the increased adoption of 5G, with its superior speeds and lower latencies, and the funding made available by local and federal governments. FWA traffic will see 20% of the total mobile network data traffic worldwide by 2026, with North America and Europe seeing the most significant growth share, the two representing nearly 60% of FWA subscribers globally.

The difficulty of laying fiber to the home/office will not change, but the prices for FWA hardware will fall as more vendors enter the market. FWA is a viable alternative to other network models given the right set of circumstances.